To help quantify climate related risks and opportunities – and to provide perspectives to our investors and other key stakeholders on how Hess’ oil and gas portfolio might be impacted by a transition to a lower carbon economy – Hess conducts an annual scenario planning exercise to assess portfolio resilience over the longer term. This scenario based approach allows us to assess and communicate to our shareholders our understanding of future risks and opportunities in relation to the potential evolution of energy demand, energy mix, the emergence of new technologies and possible changes by policymakers with respect to greenhouse gas emissions.

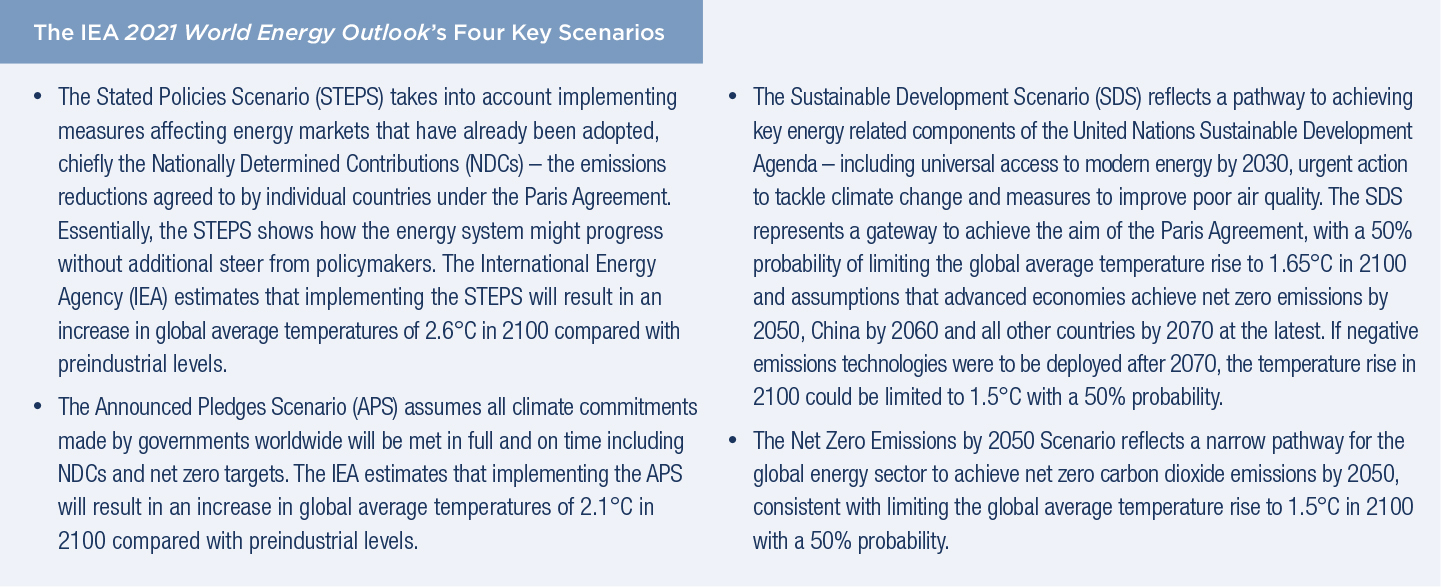

In accordance with the Task Force on Climate-Related Financial Disclosures’ (TCFD's) recommended transparency around key parameters, assumptions and analytical choices, Hess has chosen to model the four key scenarios detailed in the International Energy Agency’s (IEA's) 2021 World Energy Outlook (WEO) against our own internal base planning case. The TCFD recommends that organizations use a scenario under which global warming is kept to well below a 2°C increase during this century, compared with preindustrial levels, to test portfolio resilience. Such scenarios usually feature a reduction in demand for oil, natural gas and coal, and a growth in clean technologies. The Sustainable Development Scenario (SDS) and Net Zero Emissions by 2050 Scenario (NZE) in the IEA’s 2021 WEO, which are part of Hess’ modeling, fit with this recommendation.

Considerations for Carbon Risk Scenario Assessment

To evaluate the potential exposure of our portfolio in a carbon constrained future, we began by considering the long range outlook for energy supply and demand, as well as for oil, natural gas and carbon prices. We have used the IEA’s 2021 WEO to examine supply and demand and oil, natural gas and carbon price scenarios through 2050 in the Stated Policies Scenario (STEPS), Announced Pledges Scenario (APS), SDS and NZE (see iea.org/reports/world-energy-outlook-2021). These scenarios are recognized as a leading industry standard and benchmark worldwide and are, therefore, an appropriate choice for an oil and gas producer such as Hess.

An important consideration when reviewing the results of our analysis is that the SDS and NZE are considered reverse engineered or “normative forecasts,” meaning they are designed to achieve a specific outcome, and the pathway to reach that outcome may be a narrow one. For example, over 50% of the reductions needed to achieve the NZE come from technologies that are currently in the demonstration or prototype stage, meaning they are not readily available on the market. The two other IEA scenarios used in our modeling, STEPS and APS, define a set of starting conditions and then project a path forward based on those conditions. Additionally, according to the IEA, the scenarios in the WEO are designed to “describe a smooth, orderly process of change,” while in practice, “energy transitions can be volatile and disjointed affairs” (2021 WEO, page 68).

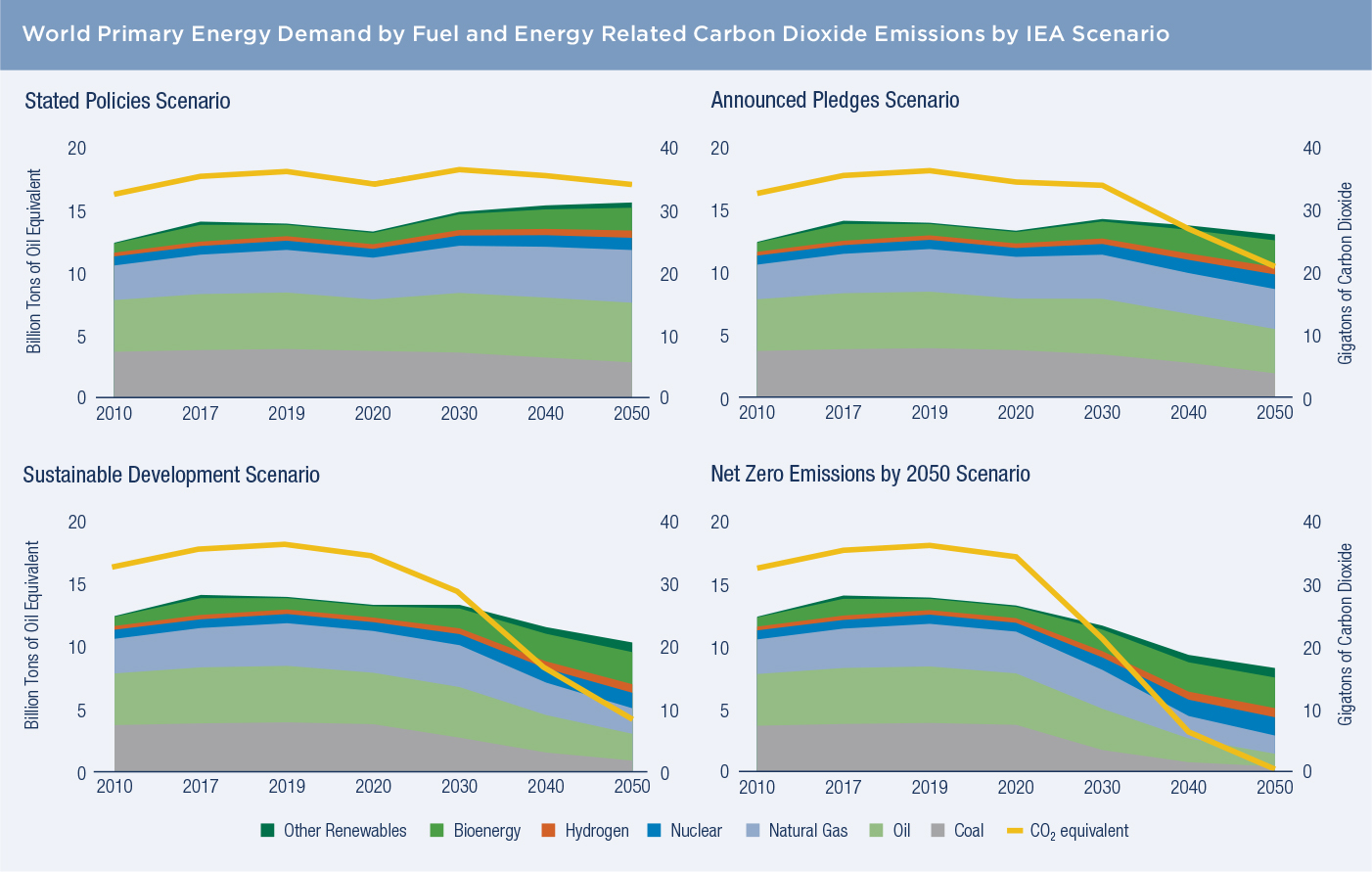

The charts below depict the 2021 WEO’s world energy supply and carbon dioxide (CO2) emissions under the IEA’s four key scenarios.

In STEPS, which is consistent with enacted energy policies and a pragmatic view of proposed policies, worldwide energy supply is expected to grow by approximately 21% between 2019 and 2050. While there is a decline in supply for coal in this scenario, between 2019 and 2050, oil and natural gas are expected to grow by 6% and 24%, respectively, and account for approximately 50% of the energy mix in 2050.

In APS, worldwide energy supply is expected to grow by approximately 10% between 2019 and 2050, while oil and natural gas supply are expected to decline by approximately 21% and 6%, respectively. However, even with this decline, oil and natural gas supply still represent over 42% of the total energy mix in 2050.

In the SDS, worldwide energy supply is projected to experience a moderate decline of approximately 6% between 2019 and 2050. Oil and natural gas supply are projected to decrease by 47% during that same time frame, accounting for approximately 30% of the energy mix in 2050.

The IEA acknowledges that society is not on the NZE pathway. In the NZE, worldwide energy supply is projected to essentially remain flat between 2019 and 2050. This scenario, which is a normative forecast, is designed to drive a specific outcome. In 2050, renewables are projected to account for approximately 67% of the total energy mix, while oil and natural gas are projected to account for approximately 20% of the energy mix.

Oil and Gas Investment in IEA’s 2021 Scenarios

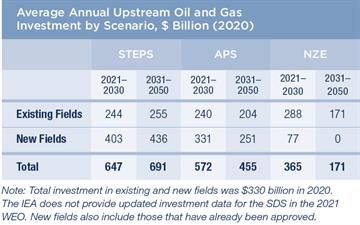

Annual upstream oil and gas investment is assumed to be significantly higher in the STEPS and APS during 2021–2050 and in the NZE during 2021–2030, when compared with 2020, in order to meet energy supply requirements (see the IEA table below).

Annual upstream oil and gas investment is assumed to be significantly higher in the STEPS and APS during 2021–2050 and in the NZE during 2021–2030, when compared with 2020, in order to meet energy supply requirements (see the IEA table below).

Hess’ Approach to Scenario Planning

The TCFD recommends that once a less than 2°C scenario is established, companies should define a base case or business as usual outlook for the future. The base case should use the same set of metrics as the less than 2°C scenario (e.g., oil demand, carbon prices and other market factors) and share the same fundamental economic foundations. Establishing multiple scenarios allows for measurement of the delta between metrics at future points to properly understand the envelope within which risk and opportunity may occur.

Hess’ approach to scenario planning is aligned with the TCFD recommendations. We have prepared internal guidance that details our approach and establishes a specified methodology. This also serves as a roadmap for our external verifier to review and verify that we followed our specified methodology when conducting this scenario analysis.

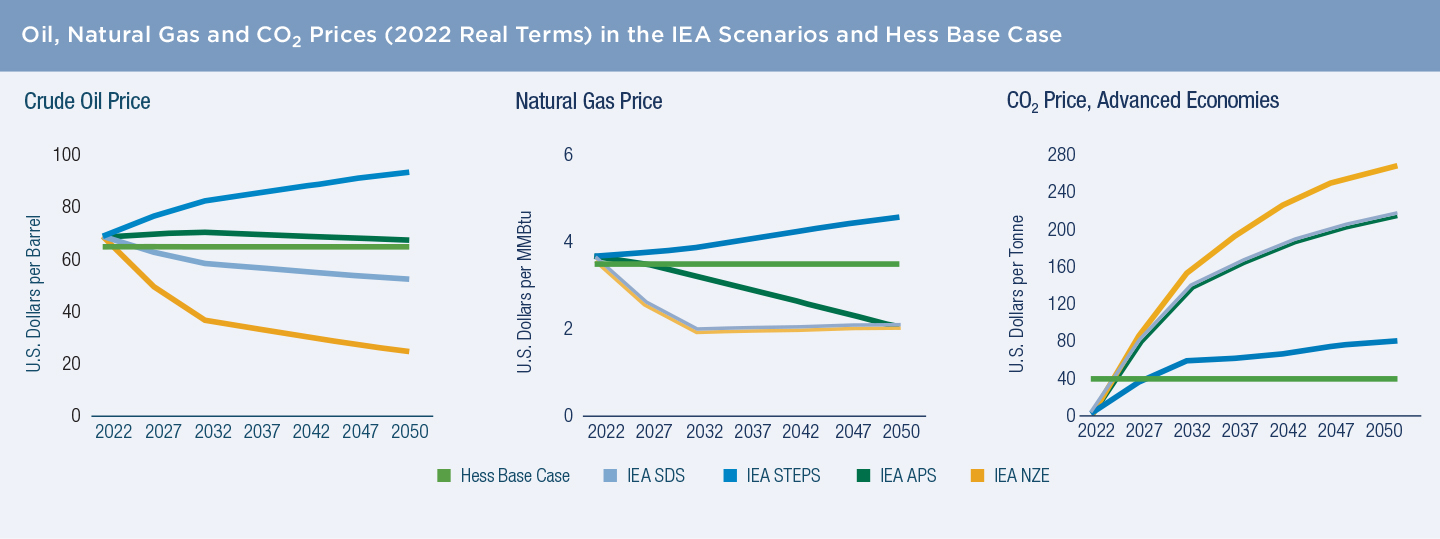

Our first step in this process was to establish a Hess base case, which for 2022 was premised off a $65 per barrel Brent oil price through 2050 and a $3.50 per million British thermal units Henry Hub natural gas price through 2050; both cost bases are in 2022 real terms. In addition, in the base case, we applied either actual carbon pricing for our assets and intended forward investments (where a regulatory framework for such exists) or used a carbon price of $40 per tonne through 2050 for other geographies.

Hess’ base case was then compared against the various oil, natural gas and carbon prices in the IEA’s four key scenarios – STEPS, APS, SDS and NZE – running our current asset portfolio and intended forward investments through these varying sets of assumptions to assess financial robustness.

The charts below show the oil and natural gas prices, as well as CO2 prices, in both advanced and developing economies under the IEA’s STEPS, APS, SDS and NZE against Hess’ base case. Please note that the IEA’s oil, natural gas and CO2 prices have been adjusted to 2022 real terms to be comparable to Hess’ base case price assumptions. As these charts show, there is a wide spread of oil, natural gas and carbon pricing across the four IEA scenarios, a key component of informed scenario planning.

Results of the Hess Scenario Planning Exercise

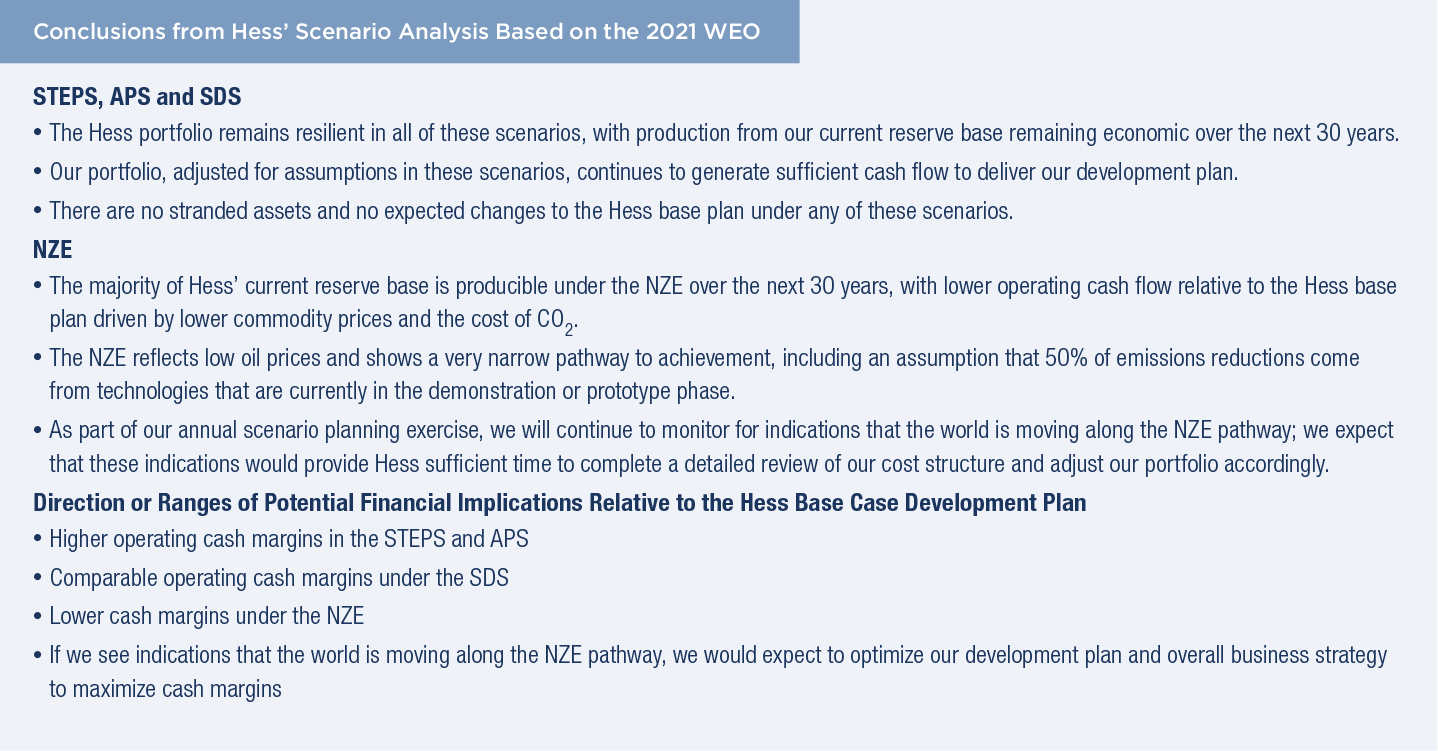

Through our methodology, we have tested the robustness of Hess’ asset portfolio and intended forward investments under multiple energy supply and demand scenarios, including the IEA’s STEPS, APS, SDS and NZE.

In discussing potential financial implications, the TCFD does not ask organizations to provide a financial forecast (for which scenario analysis is not appropriate). Organizations are asked to provide an indication of direction or ranges of potential financial implications. While we do not publish quantitative financial results due to their confidential nature, we are providing a range of potential financial implications from the various IEA scenarios, as detailed below

Validation of Hess Strategy

If the lower oil demand assumed in the IEA’s NZE comes to fruition, industry competition will intensify and higher cost producers may be forced out of the marketplace. Hess’ strategic priorities, which uniquely position us to deliver long term value, are to deliver (1) high return resource growth, (2) a low cost of supply and (3) industry leading cash flow growth. This strategy is consistent with the IEA’s less than 2°C scenarios, which envision a meaningful role for oil and natural gas through 2050.

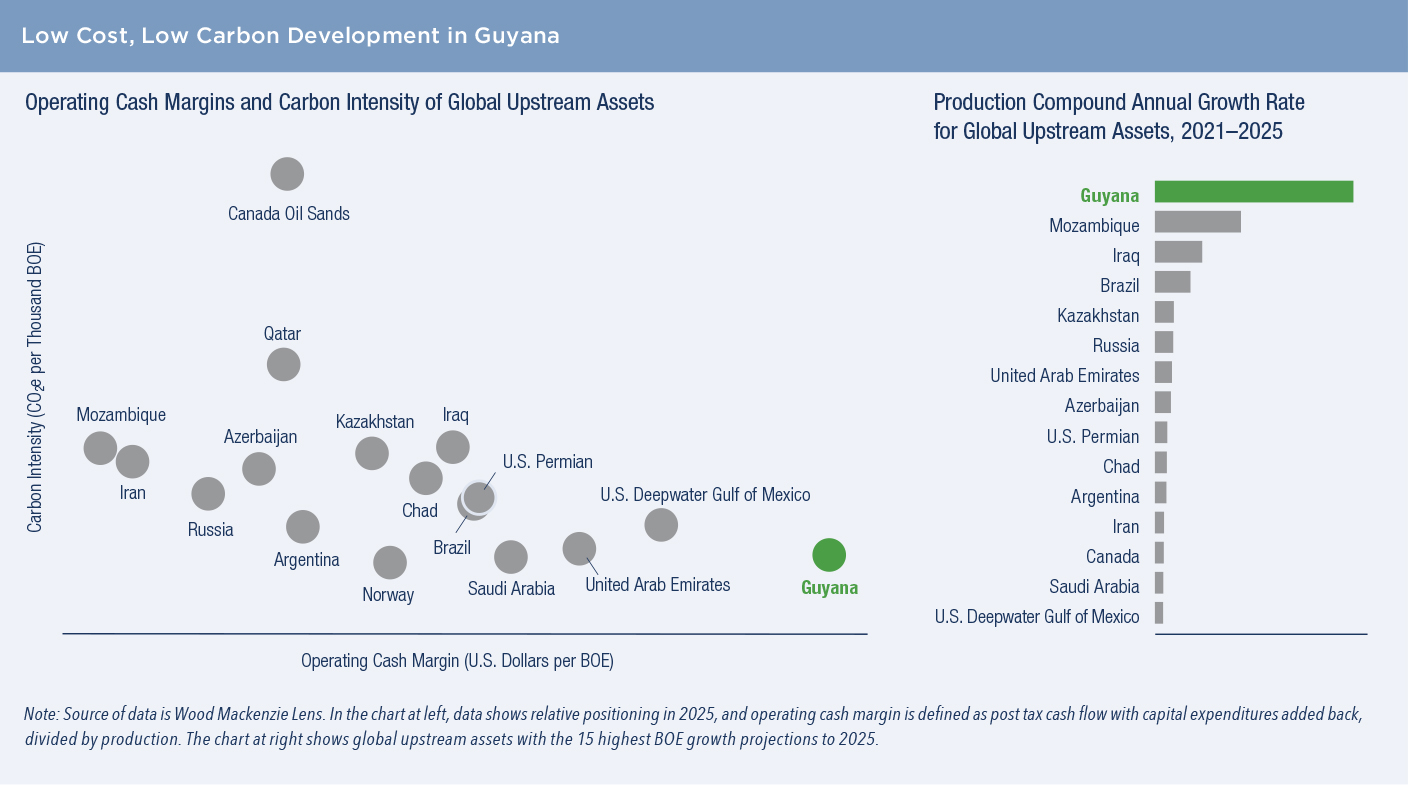

Hess plans to allocate the majority of our capital expenditures to developing the company’s assets offshore Guyana and in the Bakken shale play in North Dakota. Our offshore oil discoveries in Guyana are among the industry’s largest discoveries made globally over the last decade, with more than 11 billion barrels of oil equivalent recoverable reserves. Our four sanctioned developments – Liza Phase 1, Liza Phase 2, Payara and Yellowtail – have a breakeven Brent oil price of between $25 and $35 per barrel. According to a study by Wood Mackenzie, Guyana is one of the highest margin, lowest carbon intensity oil developments globally.

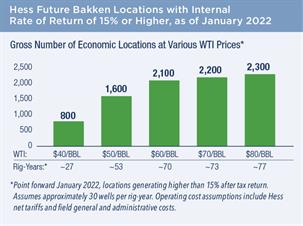

In the Bakken, Hess has approximately 800 and 1,600 locations at $40 per barrel and $50 per barrel West Texas Intermediate (WTI), respectively, that can generate at least a 15% internal rate of return. That equates to greater than 27 to 53 rig years for the company, assuming one rig drills 30 wells per year, as illustrated just below.

In the Bakken, Hess has approximately 800 and 1,600 locations at $40 per barrel and $50 per barrel West Texas Intermediate (WTI), respectively, that can generate at least a 15% internal rate of return. That equates to greater than 27 to 53 rig years for the company, assuming one rig drills 30 wells per year, as illustrated just below.

We expect that Guyana’s low breakeven costs, along with aggressive cost reduction activities in the Bakken, will contribute substantially to structurally lowering our portfolio breakeven costs to less than $45 per barrel Brent oil by 2026. Notably, this is lower than the oil price assumption through 2030 in the STEPS, APS and SDS. As a result, Hess is well positioned to retain our share in the marketplace as a low cost producer, even with the gradually reducing global oil demand projected under the IEA’s various scenarios.

In summary, based on the results of our 2022 scenario planning analysis, we conclude that we can produce our current reserve base and deliver a strong performance under the STEPS, APS and SDS and produce the majority of our current reserve base under the NZE.